City of Chicago's Reassessment Results Released on New Data Dashboard

Monday, May 16, 2022

Total Assessed Value grows 31% since 2018; Non-residential value grows 56%

Cook County – Cook County Assessor Fritz Kaegi released a data dashboard that displays where property assessments rose and fell in every Chicago neighborhood following the city’s 2021 reassessment.

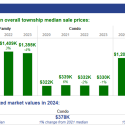

Chicago’s total Assessed Value (AV) grew 31% since its last reassessment, from $35.87b in 2018 to $47.02b in 2021.

Residential AV growth (10%) was outpaced by AV growth in all other property classes (56%), which reduces homeowners’ share of total AV and will have an effect on property tax bills released in 2022.

“My office’s 2021 reassessment of nearly nine hundred thousand homes, apartments, grocery stores, and high-rise office buildings is like a property tax reset for Chicagoans,” said Cook County Assessor Fritz Kaegi. “Better data, more staff, and improved transparency are producing better, fairer assessments that people can understand and trust.”

A 31% increase in AV does not mean property taxes will increase 31%. Assessments shift who pays what share of the total tax levy. When the share of one property owner or neighborhood grows, another owner or neighborhood’s share shrinks. The total amount of the property tax levy to be collected is set by taxing bodies like the City of Chicago, Chicago Public Schools, and others.

Three years of assessed value growth reflected in the 2021 reassessment is good news for most Chicago property owners.

- Homeowners: Residential AV growth (10%) was outpaced by AV growth in all other property classes (56%). This reduces homeowners’ share of total AV.

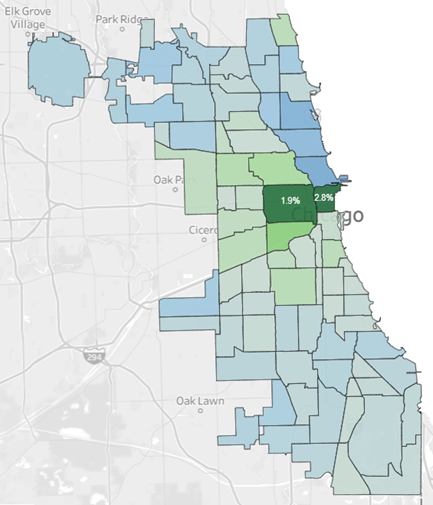

- Neighborhoods: Most of Chicago’s share of AV growth is concentrated in the Loop, River North, and West Loop areas. This causes reductions in the property tax share throughout neighborhoods in the north and south sides of the City.

- Retail property owners: The reassessment captured conditions for property types in each neighborhood. For example, total AVs for large commercial buildings grew 67% in the Loop, but shrank -13% in Englewood.

On the Assessor’s Office’s 2021 Property Tax Reassessment dashboard, taxpayers can view the assessment report for the City, review assessment changes and the top 5 highest-dollar properties in every neighborhood, and compare assessments between neighborhoods and property types.

Data Dashboard

Due to more accurate assessments, appeals in Chicago declined 28% compared to 2018, with nearly 35,000 fewer appeals filed.

“A drastic reduction in appeals shows we are creating more accurate assessments for most property owners – homeowners and commercial property owners alike,” Kaegi said. “The biggest reductions in appeals are in Hyde Park and West Chicago townships. For property owners who felt they were overassessed in the past, the 2021 assessments appear to have corrected those concerns.”

“A drastic reduction in appeals shows we are creating more accurate assessments for most property owners – homeowners and commercial property owners alike,” Kaegi said. “The biggest reductions in appeals are in Hyde Park and West Chicago townships. For property owners who felt they were overassessed in the past, the 2021 assessments appear to have corrected those concerns.”

Although the Assessor’s Office completed its assessment work and finalized the 31% growth in Chicago’s AV in April, Chicago’s tax rate and bills for 2021 have not yet been calculated.

When the tax base grows, tax rates shrink. When Chicago was last reassessed in 2018, its AV grew 16.4%, and its tax rate shrank 6.6% . Chicago’s property tax rate in 2021 will be affected by other components of the property tax system that can shrink this tax base growth (increasing the tax rate).

Below are three factors that will shrink the tax base.

- Assessment reductions made by the Cook County Board of Review, which has not yet completed its work for 2021.

- TIF districts enacted by municipalities that freeze growth in the tax base in certain areas.

- Exemptions that provide property tax savings for homeowners, seniors, veterans, and persons with disabilities. Many exemptions will automatically renew. Newly eligible homeowners will soon receive mail from the Assessor’s Office with options to apply online or by mail for free.

Visit cookcountyassessor.com to see the Chicago dashboard, apply for exemptions, and see reassessment reports for homes and for commercial properties.